Accomplishing great things takes time. Recognizing this, CBGF is structured so we can take a long-term and patient approach with our investments.

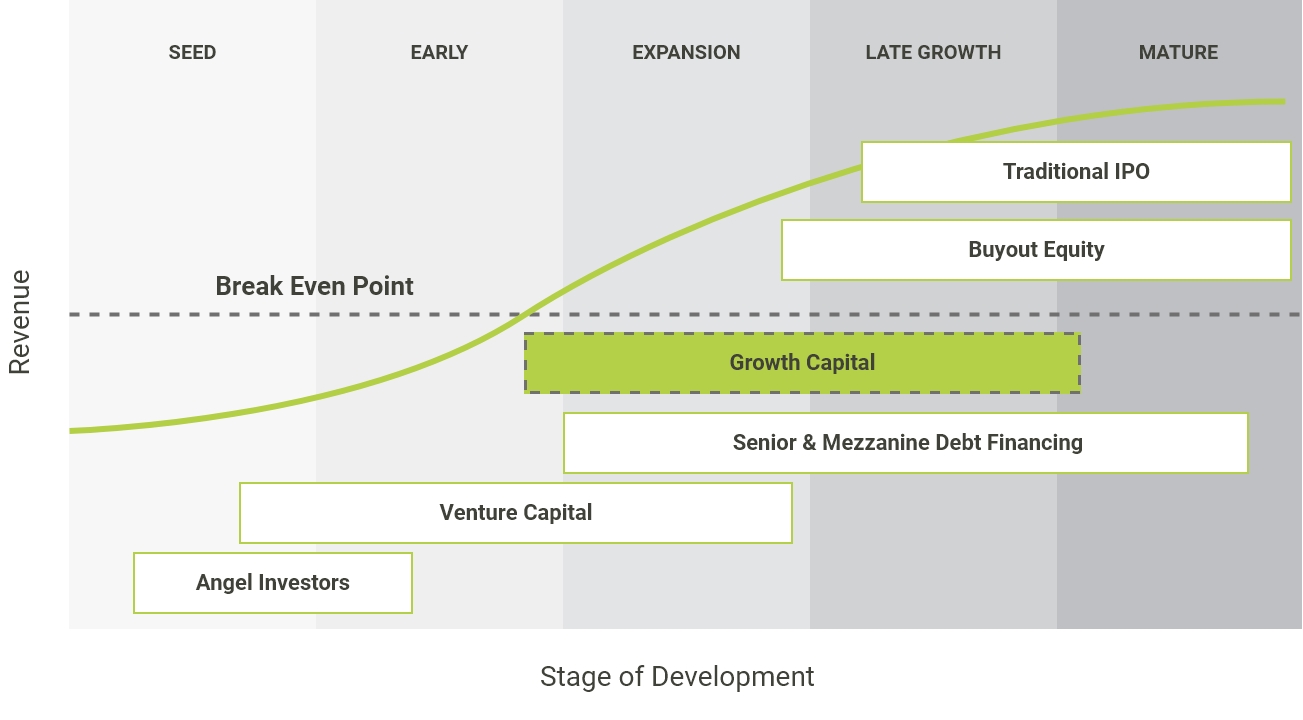

Why Growth Capital?

Many mid-market Canadian companies identify growth as their primary objective, but there is a lack of patient minority capital to support their expansion plans. Without the right kind of growth capital, businesses are unable to scale up and miss the opportunity to become large businesses.

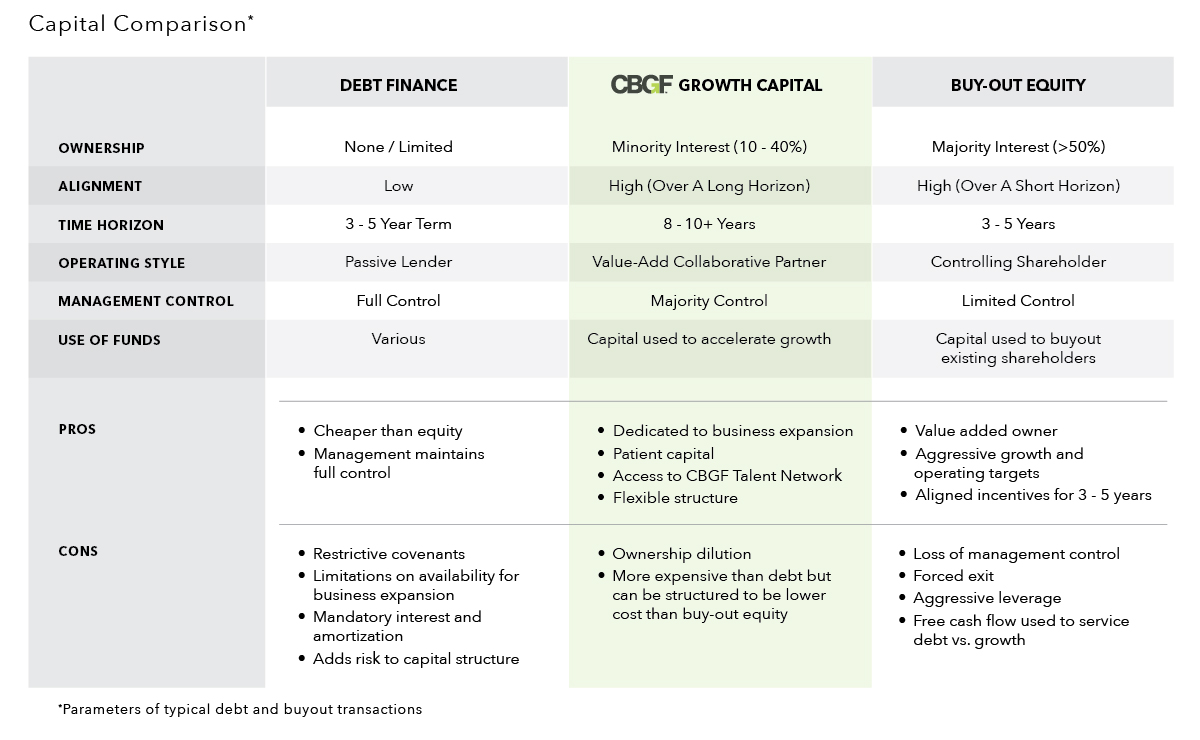

Canadian entrepreneurs tell a common story when asked about their options for financing growth. There is a lot of debt financing available, but it has its limits for financing growth and many entrepreneurs have an aversion to high leverage. There are many private equity buyout firms they could sell to, but many entrepreneurs are not ready to sell completely or to work for a controlling shareholder.

CBGF Differentiation

When entrepreneurs are looking for a solution in the middle – a patient equity investment where they can maintain control of their business, with a Canadian-based team – they often don’t know who to call.

CBGF fills this market void and provides a compelling Canadian option for businesses that need a capital partner but want long-term alignment around control, strategy, and exit horizon.

Our vision is to be the capital provider of choice for entrepreneurs with ambitious growth plans, where we can help companies determine the capital and resources needed to achieve their goals.